The demand for free insurance card templates is surging, driven by individuals and small businesses seeking cost-effective solutions to manage their insurance information. This guide navigates the complexities of creating and using these templates, addressing design best practices, legal considerations, and accessibility requirements.

From understanding user needs to navigating the legal minefield of data privacy, we explore the complete lifecycle of a free insurance card template.

This exploration delves into the practical aspects of template creation, comparing available options, highlighting design flaws to avoid, and emphasizing the critical importance of data security and regulatory compliance. We’ll examine various file formats, marketing strategies, and methods for gathering user feedback to continuously improve the template’s functionality and accessibility.

Understanding User Needs for Free Insurance Card Templates

The search for “insurance card template free” reveals a significant segment of the population navigating the complexities of insurance administration with limited resources. These individuals often prioritize cost-effectiveness and ease of access, opting for readily available digital solutions over professional design or printing services.

Understanding their motivations and challenges is crucial for developing effective and user-friendly templates.The typical profile of someone seeking a free insurance card template encompasses a broad range of demographics and financial situations. This includes individuals and small businesses seeking economical alternatives to professional design and printing, those with limited technical skills comfortable with simple templates, and those needing quick solutions for immediate needs, such as replacing a lost card.

Key Reasons for Utilizing Free Templates

The primary driver behind the demand for free insurance card templates is cost reduction. Printing costs, design fees, and even the expense of purchasing premium templates can be prohibitive for many individuals, particularly those with limited budgets or those managing multiple insurance policies.

Additionally, the convenience of readily available digital templates eliminates the need for external services and expedites the process of creating and printing necessary cards. This speed and simplicity are especially valuable in emergency situations or when immediate replacement is required.

Challenges Associated with Free Templates

While free templates offer significant advantages, users often encounter challenges. Many free templates lack customization options, limiting the ability to accurately reflect specific policy details or branding. This can lead to confusion or even rejection by insurance providers.

Furthermore, the quality of free templates can vary considerably; some may lack professional design elements or include formatting errors, potentially compromising readability and professionalism. Security concerns are also a factor, as some free templates may not adequately protect sensitive personal information.

For instance, a poorly designed template might not obscure crucial data like policy numbers, potentially increasing the risk of identity theft.

Types of Insurance Cards Requiring Templates

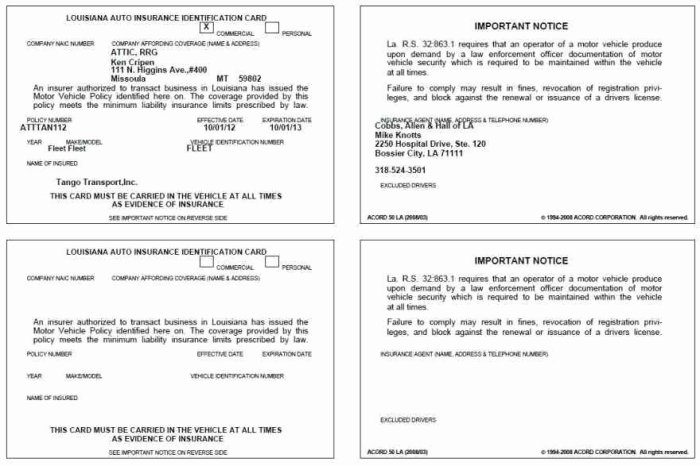

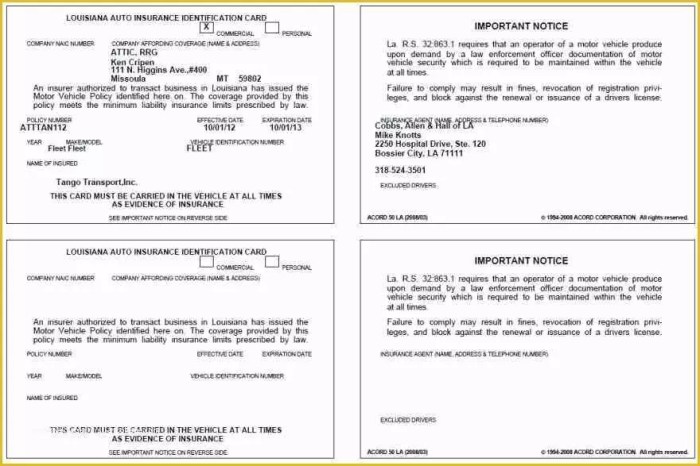

The need for insurance card templates extends across various insurance types. Health insurance cards are perhaps the most common, with individuals requiring readily accessible templates for personal use or for providing information to healthcare providers. Auto insurance cards are equally vital for demonstrating proof of insurance to law enforcement and other parties.

Other types of insurance, including homeowners, renters, life, and travel insurance, may also benefit from the use of readily available templates for documenting policy details and contact information. The specific requirements for each type of card vary, highlighting the need for templates that are both versatile and adaptable to diverse insurance needs.

Analyzing Available Free Insurance Card Templates Online

The proliferation of free insurance card templates online presents both opportunities and challenges. While readily accessible options offer convenience and cost savings, a critical evaluation of their features, design, and legal implications is crucial before implementation. This analysis examines several readily available templates, highlighting their strengths and weaknesses to inform users’ choices.

Comparison of Free Insurance Card Templates

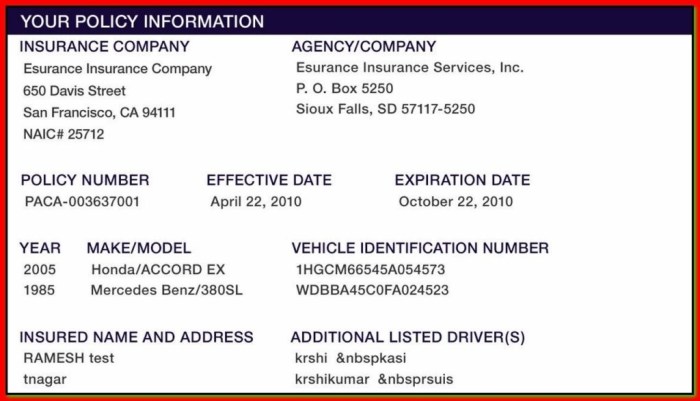

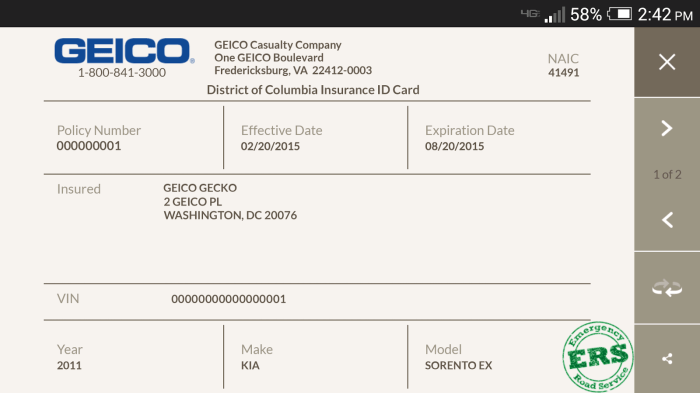

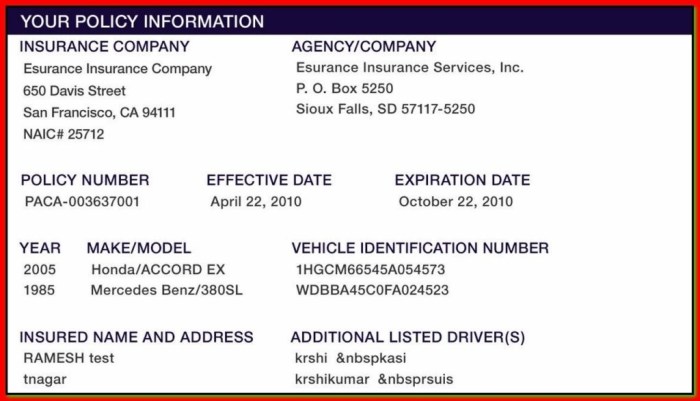

Three distinct free templates, sourced from different online platforms, reveal a range of design approaches and functionalities. Template A, found on a general design resource website, features a simple, minimalist layout prioritizing readability. Its strengths lie in its clear typography and straightforward information hierarchy.

However, it lacks customization options and sophisticated design elements. Template B, from a dedicated healthcare resource site, incorporates a more visually appealing design, using color-blocking and subtle imagery to enhance brand identity. Its downside is a slightly cluttered layout that could compromise readability on smaller screens.

Finally, Template C, originating from a template marketplace, offers greater customization, allowing users to adjust colors, fonts, and even add logos. However, its extensive options might overwhelm users unfamiliar with design software. The templates illustrate the trade-off between simplicity and customizability inherent in free options.

Examples of Well-Designed Free Templates and Their Strengths

A well-designed free template should balance functionality with aesthetics. One exemplary template, similar to Template A described above, prioritizes clear, concise information display. Its strength lies in its clean, uncluttered design, ensuring critical information (policy number, member ID, contact details) is easily accessible.

The use of a legible sans-serif font further enhances readability. Another example, akin to Template B, showcases effective use of color to visually segment information, improving scannability. The strategic use of a muted background color prevents visual overload, enhancing the overall user experience.

These examples demonstrate that effective design in free templates doesn’t necessitate complex elements; rather, it prioritizes clarity and user-friendliness.

Common Design Flaws in Freely Available Templates

Many free templates suffer from common design flaws. Poor typography, including the use of illegible fonts or inconsistent font sizes, frequently hinders readability. Overuse of decorative elements, such as excessive borders or clip art, can clutter the design and distract from crucial information.

Inconsistent spacing and alignment create a disorganized look, impacting the overall professional appearance. Furthermore, lack of responsiveness, meaning the template doesn’t adapt well to different screen sizes (desktop, mobile), limits usability. These shortcomings highlight the importance of careful selection and potential need for minor design adjustments even when using free templates.

Legal Implications of Using Free Templates Versus Professionally Designed Ones

Using free templates carries potential legal risks. Copyright infringement is a major concern; using a template without proper licensing could lead to legal action. Furthermore, free templates might lack the necessary security features to protect sensitive personal information, potentially violating data privacy regulations.

Professionally designed templates, on the other hand, typically come with licenses ensuring legal compliance and often include enhanced security measures. The potential cost savings from using free templates must be weighed against the potential legal and reputational risks associated with non-compliance.

While a free template might seem cost-effective initially, the potential liabilities could far outweigh any short-term savings.

Designing a Functional and Visually Appealing Template

Creating a free insurance card template requires careful consideration of both functionality and aesthetics. A well-designed template ensures crucial information is readily accessible while maintaining a professional and user-friendly appearance. This balance is critical for maximizing usability and positive user experience.The design process should prioritize clear communication of essential data, utilizing visual hierarchy and design principles to guide the user’s eye.

A visually appealing template encourages users to retain and utilize the card effectively.

Responsive Two-Column Layout Using HTML Table

A responsive two-column layout, implemented using HTML table tags, provides an effective method for organizing information on insurance cards. This approach ensures readability across various screen sizes. The following example demonstrates a basic structure:

| Policy Information | Personal Information |

|---|---|

| Policy Number: 1234567890 | Name: John Doe |

| Group Number: 9876543210 | Date of Birth: 01/01/1980 |

| Effective Date: 01/01/2024 | Phone Number: 555-123-4567 |

| Insurer: Acme Insurance | Address: 123 Main Street, Anytown, CA 90210 |

This table-based structure allows for easy adaptation to different screen sizes and ensures that information remains clearly organized and accessible. The use of `

Visually Appealing Template Design Using Text-Based Descriptions

A visually appealing template relies on strategic font choices, color schemes, and layout. A sans-serif font like Arial or Helvetica, known for its readability, is suitable for body text. A more prominent serif font, such as Garamond or Times New Roman, could be used for headings to add a touch of formality.The color scheme should be professional and easy on the eyes.

A combination of a dark-blue or green for headings, coupled with a light gray or off-white background, creates a visually appealing contrast that enhances readability. Avoid using clashing or overly bright colors.The layout should prioritize a clean and uncluttered appearance.

Information should be logically grouped and presented with sufficient white space to avoid overwhelming the user. Consistent use of margins and padding contributes to a professional and well-organized look.

Clear and Concise Information Display

Prioritizing clear and concise information display is paramount. Use bullet points or short, declarative sentences to present key details. Avoid jargon or overly technical language. Essential information, such as policy number, effective date, and contact information, should be prominently displayed.

The font size should be large enough to be easily readable, particularly for users with visual impairments. The use of bolding or underlining can highlight crucial details.

QR Code Integration for Digital Access

Integrating a QR code provides a convenient method for accessing digital insurance information. The QR code should link to a secure online portal where users can view their policy details, claims history, and other relevant information. The QR code should be prominently displayed on the template, possibly near the policy number for easy location.

A clear indication of its purpose (e.g., “Scan for Digital Access”) should accompany the QR code to avoid confusion. The use of a QR code generator tool is recommended to create a high-quality, easily scannable code.

Content Considerations for Insurance Card Templates

Creating effective insurance card templates requires careful consideration of the information presented and how it’s displayed. A well-designed template ensures clarity, minimizes errors, and provides readily accessible crucial details for policyholders. Poor design, conversely, can lead to confusion and potentially hinder access to necessary healthcare or other services.The inclusion of essential information is paramount.

Ambiguity must be avoided at all costs to prevent misinterpretations that could have serious consequences. Formatting should prioritize readability, ensuring critical data is easily located and understood at a glance.

Essential Information for Insurance Cards

An insurance card should present information concisely and clearly. This includes the policyholder’s name, policy number, group number (if applicable), and the insurer’s name and contact information. Crucially, it should also display the effective dates of coverage, specifying the start and end dates of the policy’s validity.

In the case of health insurance, the card should clearly indicate the type of plan (e.g., HMO, PPO) and any relevant identification numbers, such as a member ID. For automobile insurance, policy number and coverage details are key.

Providing a customer service number for immediate inquiries is also highly beneficial.

The Importance of Clear and Unambiguous Language

Using clear and unambiguous language is non-negotiable. Jargon or technical terms should be avoided. All information must be presented in plain language, easily understandable by individuals with varying levels of literacy. This is critical for ensuring the policyholder can quickly and accurately understand their coverage details in emergency situations.

For instance, instead of “indemnification,” use “compensation” or “payment.” Instead of “pre-authorization,” use “prior approval.”

Potential Data Fields for a Versatile Template

A versatile insurance card template should accommodate a range of data fields to cater to different insurance types. The following list represents a comprehensive set of potential data fields:

- Policyholder Name (First, Middle, Last)

- Policy Number

- Group Number (if applicable)

- Insurer Name

- Insurer Contact Information (Phone, Address, Website)

- Effective Dates (Start and End)

- Plan Type (e.g., HMO, PPO, etc.)

- Member ID Number

- Dependent Information (if applicable)

- Coverage Details (e.g., deductible, copay)

- Emergency Contact Information

- QR Code linking to online policy details

Best Practices for Data Formatting

Effective formatting is crucial for readability. Use a clear and consistent font size and style throughout the card. Employ visual cues such as bolding or underlining to highlight key information like policy numbers and effective dates. Group related information logically, using clear headings or sections.

Maintain ample white space to prevent the card from appearing cluttered. Consider using a barcode or QR code for quick access to online policy information. The overall design should be visually appealing yet functional, ensuring ease of access to critical details.

Legal and Privacy Implications of Free Templates

The seemingly innocuous act of downloading a free insurance card template carries significant legal and privacy risks. Using such templates without careful consideration can expose both individuals and organizations to substantial liabilities, particularly concerning the handling of sensitive personal information.

Compliance with stringent data privacy regulations is paramount, and failure to do so can result in severe penalties.The use of free insurance card templates presents several potential legal pitfalls. First, the templates themselves may not be legally compliant with all applicable regulations.

They might lack the necessary security features or fail to adequately address data protection requirements. Secondly, the act of collecting, storing, and transmitting Protected Health Information (PHI) via a template sourced from an untrusted provider introduces significant risk.

Finally, improper use of a template can lead to inadvertent breaches of confidentiality, potentially exposing individuals to identity theft or other forms of fraud.

Data Privacy Regulation Compliance

Compliance with regulations such as the Health Insurance Portability and Accountability Act (HIPAA) in the United States and the General Data Protection Regulation (GDPR) in the European Union is critical. HIPAA mandates specific security measures for protecting PHI, including administrative, physical, and technical safeguards.

GDPR, similarly, establishes stringent rules around data processing, consent, and individual rights regarding their personal data. Using a free template that doesn’t inherently incorporate these safeguards leaves users vulnerable to non-compliance and potential fines. For instance, a template failing to encrypt data transmitted electronically would violate HIPAA’s security rule, exposing the user to significant penalties.

Similarly, a template lacking mechanisms for data subject access requests would violate GDPR.

Security Measures for Sensitive Information

Protecting sensitive information on insurance cards requires robust security measures. Free templates often lack these crucial elements. Essential safeguards include data encryption (both at rest and in transit), access control mechanisms (limiting who can view and modify data), and regular security audits to identify and address vulnerabilities.

A template should ideally incorporate features such as password protection and data validation to minimize the risk of unauthorized access and data corruption. The absence of these features in a free template dramatically increases the likelihood of a data breach.

Consider a scenario where an individual uses a free template without encryption; a simple phishing attack could expose all the PHI stored on the template.

Consequences of Non-Compliance

Non-compliance with HIPAA, GDPR, and other relevant data privacy regulations can lead to severe consequences. These can include hefty financial penalties, reputational damage, legal action from affected individuals, and even criminal charges in some cases. The penalties under HIPAA, for example, can range from several hundred dollars per violation to millions of dollars for widespread breaches.

GDPR violations can result in fines up to €20 million or 4% of annual global turnover, whichever is greater. Beyond the financial implications, a data breach can severely damage an organization’s credibility and trust with its clients. For example, a healthcare provider using a non-compliant template resulting in a PHI breach could face lawsuits, loss of patients, and significant damage to its reputation.

Accessibility Considerations for Insurance Card Templates

Designing accessible insurance card templates is crucial for ensuring inclusivity and usability for all individuals, regardless of their abilities. Failure to do so can exclude a significant portion of the population from easily accessing vital health information. This necessitates careful consideration of visual impairments, screen reader compatibility, and overall design principles for universal accessibility.

Color Contrast for Improved Readability

Sufficient color contrast is paramount for readability, particularly for individuals with low vision or color blindness. WCAG (Web Content Accessibility Guidelines) 2.1 recommends a minimum contrast ratio of 4.5:1 for normal text and 3:1 for large text (18pt or 14pt bold).

This means the difference in luminance between the text and its background must meet these ratios. For example, using dark text on a light background, or vice versa, with appropriate color choices, ensures sufficient contrast. Tools are available online to check contrast ratios before finalizing the design.

Ignoring these guidelines risks illegibility, potentially leading to missed appointments or incorrect medication dosages.

Screen Reader Compatibility

Screen readers rely on proper semantic HTML structure to accurately convey information to visually impaired users. Insurance card templates should utilize appropriate HTML5 tags such as <h1>to <h6>for headings, <p>for paragraphs, <strong>for emphasis, and <label>for form fields. Meaningful alt text should accompany any images or icons, providing a concise description of their content.

Furthermore, the information should be logically structured and presented in a linear fashion to ensure the screen reader can accurately interpret the data. Failure to follow these guidelines may result in the screen reader providing a garbled or incomplete representation of the insurance card’s crucial information.

Accessibility for Visual Impairments

Addressing the needs of individuals with visual impairments involves a multi-faceted approach. Beyond color contrast and screen reader compatibility, the use of clear and concise fonts in a legible size is vital. Sans-serif fonts generally offer better readability than serif fonts for digital contexts.

The template should avoid excessive use of visual clutter, keeping the design clean and focused on essential information. Consider incorporating features like larger font sizes, bolding key information, and providing clear spacing between elements to enhance readability. A well-structured PDF, employing tagged PDFs, can also improve accessibility for screen reader users.

For example, using logical headings and table structures allows the screen reader to better parse and communicate the information contained within the template.

Universally Accessible Design Best Practices

Creating a universally accessible design requires adhering to established accessibility guidelines, such as WCAG. This involves testing the template with assistive technologies, including various screen readers and magnification software, to identify and address potential accessibility barriers. Seeking feedback from individuals with disabilities during the design and testing phases is invaluable in ensuring the template meets their needs.

Regular audits and updates to maintain compliance with evolving accessibility standards are also crucial. Furthermore, the use of keyboard navigation, ensuring all interactive elements are accessible via keyboard only, is essential for users who cannot use a mouse.

Exploring Different File Formats for Templates

The selection of the appropriate file format for a free insurance card template significantly impacts user experience, accessibility, and overall usability. Different formats offer distinct advantages and disadvantages, necessitating careful consideration based on the intended audience and application. This section will analyze the most common formats—PDF, DOCX, and others—highlighting their strengths and weaknesses to guide informed decision-making.

File Format Comparison: PDF, DOCX, and Others

Choosing between PDF, DOCX, and other formats involves weighing several factors. PDFs (Portable Document Format) are known for their reliability in preserving formatting and ensuring consistent display across different platforms. However, they are generally not easily editable by users.

DOCX (Microsoft Word Open XML Document), on the other hand, offers superior editing capabilities, allowing users to customize the template. However, this flexibility can lead to inconsistencies in formatting depending on the user’s software and settings. Other formats, such as JPEG or PNG, might be suitable for simple visual representations of an insurance card, but lack the data-handling capabilities needed for storing essential information.

Choosing a File Format Based on User Needs

The optimal file format directly correlates with user needs. For users requiring a readily printable, visually consistent insurance card, a PDF is the preferred choice. Its immutability ensures that the crucial information remains unchanged and accurately displayed during printing.

Conversely, if the template is intended for users to readily edit and personalize, a DOCX format is more suitable. This allows for adjustments to personal details, such as policy numbers or member names, before printing. A simpler image format might be sufficient for a visual representation, perhaps for online display, but not for storing critical data.

Compatibility Issues Across Different File Formats

Compatibility issues are a significant concern. While PDFs generally offer excellent cross-platform compatibility, older software versions or specific devices might have limited rendering capabilities. Similarly, DOCX files rely on Microsoft Word or compatible software; users lacking access to this software will be unable to edit or view the template correctly.

Other formats may have even more stringent compatibility requirements, potentially limiting accessibility for a large user base. Using widely adopted and well-supported formats minimizes these issues.

Ensuring Consistent Display Across Devices and Software

To ensure consistent display, template designers should adhere to best practices. For PDFs, employing vector graphics instead of raster graphics reduces pixelation and ensures sharp rendering at various resolutions. For DOCX, carefully selecting fonts and avoiding complex formatting that might not be rendered consistently across different versions of Microsoft Word or other word processors is crucial.

Using standard fonts and avoiding overly intricate designs significantly improves cross-platform compatibility. Thorough testing across different devices and software versions before release is essential to identify and resolve any inconsistencies.

Marketing and Distribution of Free Templates

Effective marketing is crucial for maximizing the reach and impact of a free insurance card template. A multi-channel approach, leveraging both online and potentially offline strategies, will ensure broad exposure to the target audience. This strategy must account for user acquisition costs and conversion rates to optimize resource allocation.A well-defined marketing strategy necessitates a clear understanding of the target audience—individuals and small businesses seeking convenient, cost-effective solutions for managing insurance information.

The chosen marketing channels must align with this audience’s online behavior and preferences. Furthermore, meticulous tracking and analysis are essential to refine the strategy over time and ensure optimal return on investment.

Landing Page Design

The landing page should feature a clear and concise headline, such as “Download Your Free Customizable Insurance Card Template Now!” A brief, compelling description highlighting the template’s key benefits—ease of use, customization options, and printable format—should follow. High-quality visuals, possibly showcasing the template’s design in use, would enhance user engagement.

A prominent, easily accessible download button is essential. The page should also include a brief privacy policy statement and a section addressing frequently asked questions. User testimonials or social proof could further build trust and credibility.

Distribution Channels

Several distribution channels can effectively disseminate the template. A dedicated website serves as a central hub, providing detailed information and facilitating downloads. Social media platforms like Facebook, Twitter, and Instagram offer targeted advertising options and organic reach opportunities.

Collaboration with relevant blogs, websites, and insurance-related forums can extend the template’s visibility to a wider audience. Search engine optimization () is crucial for improving organic search ranking and driving traffic to the website. Consider listing the template on relevant online directories or resource sites frequented by the target audience.

Marketing Effectiveness Tracking

Tracking the marketing strategy’s effectiveness requires implementing appropriate analytics tools. Website analytics platforms like Google Analytics can monitor website traffic, user behavior, and conversion rates (downloads). Social media analytics provide insights into post engagement, reach, and click-through rates from social media advertisements.

UTM parameters appended to URLs allow tracking of traffic originating from specific marketing campaigns. A/B testing of different marketing materials and landing page elements can help optimize performance. Regular analysis of this data allows for continuous refinement of the marketing strategy, improving its efficiency and ROI.

For example, if social media advertising campaigns show a low conversion rate, adjustments might involve refining targeting parameters or altering the ad creative.

User Feedback and Template Refinement

Iterative refinement based on user feedback is crucial for creating a truly effective and user-friendly free insurance card template. A robust feedback mechanism allows for continuous improvement, ensuring the template meets the evolving needs of its users and remains competitive in a dynamic market.

Ignoring user input risks creating a template that is ultimately underutilized and fails to achieve its intended purpose.Gathering user feedback requires a multi-pronged approach. Effective strategies are essential to ensure a representative sample and actionable insights.

Feedback Collection Methods

Several methods can be employed to effectively gather user feedback. These methods should be integrated to provide a comprehensive understanding of user experience. Online surveys, utilizing platforms like SurveyMonkey or Typeform, allow for large-scale data collection. These surveys can incorporate rating scales, multiple-choice questions, and open-ended text fields to capture both quantitative and qualitative data.

Furthermore, incorporating user testing sessions, involving a small group of representative users interacting with the template, provides valuable qualitative insights into usability and user workflows. Direct email communication, following template download or usage, offers a personalized approach to gather targeted feedback.

Finally, social media monitoring can passively collect feedback and identify emerging issues or trends. The combination of these methods allows for a richer, more nuanced understanding of user experience.

Feedback Analysis and Improvement Identification

Analyzing user feedback requires a systematic approach to identify recurring themes and actionable insights. Quantitative data from surveys, such as average ratings and frequency of specific responses, highlight areas requiring immediate attention. Qualitative data, gathered through open-ended questions and user testing, provides deeper context and understanding behind the quantitative findings.

Thematic analysis of qualitative data helps to identify recurring patterns and user pain points. For example, consistently negative feedback about the template’s font size might indicate a need for improved readability. Similarly, recurring difficulties in navigating specific sections might suggest a need for improved layout and design.

By combining both quantitative and qualitative data, a comprehensive picture of user experience emerges, informing targeted improvements.

Iterative Improvement Plan

An iterative improvement plan should prioritize the most impactful changes based on the analysis of user feedback. Prioritization can be based on the severity of the issue, the number of users affected, and the feasibility of implementation. A phased approach allows for manageable updates and minimizes disruption.

For instance, addressing critical usability issues should take precedence over minor aesthetic changes. Each iteration should include clear documentation of changes made and their rationale. This ensures transparency and allows for easy tracking of progress. A version control system is essential for managing different iterations of the template and facilitating easy rollback if needed.

Implementation and Release of Updated Versions

Implementing changes involves updating the template design and code, followed by rigorous testing to ensure functionality and usability. Thorough testing should include both automated testing and manual user testing to identify any unforeseen issues. Once testing is complete, the updated template can be released.

Communicating the changes and improvements to users is crucial for maintaining engagement and encouraging continued feedback. This can be done through email announcements, social media updates, and website notifications. The release notes should clearly Artikel the changes made and the rationale behind them.

This ensures transparency and builds trust with users. Regularly releasing updated versions demonstrates a commitment to continuous improvement and responsiveness to user needs.

Future Trends in Insurance Card Templates

The insurance card, a seemingly static piece of paper, is poised for a significant transformation driven by technological advancements and evolving user expectations. The next five years will likely witness a dramatic shift from the traditional physical card to a more dynamic, digitally integrated ecosystem.The integration of emerging technologies will redefine the functionality and accessibility of insurance cards.

This evolution will be driven by a need for increased security, enhanced user experience, and seamless integration with existing digital platforms.

Blockchain Technology’s Impact on Insurance Cards

Blockchain technology offers the potential to significantly enhance the security and transparency of insurance information. By storing insurance data on a decentralized, immutable ledger, blockchain can reduce the risk of fraud and data breaches. Imagine a future where insurance card information is verified instantly and securely using blockchain, eliminating the need for cumbersome manual verification processes.

This could lead to faster claims processing and improved customer service. For example, a patient’s insurance information could be instantly verified at the point of care, streamlining the billing process and reducing administrative overhead for both the patient and the healthcare provider.

Future Features and Functionalities of Insurance Card Templates

Future insurance card templates will likely incorporate several advanced features. Dynamic QR codes, for instance, could provide instant access to policy details, claims history, and provider networks directly from a smartphone. Biometric authentication could replace traditional passwords, enhancing security.

Real-time updates to policy information, such as changes in coverage or deductible amounts, could be instantly reflected on the digital card. The ability to customize the displayed information based on the specific needs of the user (e.g., showing only relevant coverage for a specific medical procedure) is another potential advancement.

Companies like Oscar Health are already incorporating digital-first approaches, paving the way for these functionalities.

Integration of Insurance Cards with Mobile Apps

The integration of insurance cards with mobile apps is a natural progression. A dedicated mobile app could serve as a central hub for managing all insurance-related information, including policy details, claims history, and provider directories. Users could access their digital insurance card at any time, anywhere, eliminating the need to carry a physical card.

Push notifications could alert users to important policy updates or upcoming deadlines. This integration would improve convenience and accessibility, enhancing the overall customer experience. Many insurers are already developing or utilizing such apps, creating a competitive landscape that pushes for innovation in this area.

Predictions for the Evolution of Insurance Card Templates in the Next Five Years

Within the next five years, we can expect to see a significant decline in the use of physical insurance cards. The transition to digital-first approaches will be driven by both consumer demand and technological advancements. The digital insurance card will become the norm, offering enhanced security, convenience, and functionality.

We can anticipate the widespread adoption of features such as dynamic QR codes, biometric authentication, and real-time policy updates. Furthermore, the integration of insurance cards with other health and wellness apps will become increasingly common, creating a more holistic and user-friendly experience for consumers.

This transition mirrors the broader trend towards digitalization in the healthcare industry, reflecting a shift towards greater efficiency and convenience.

Final Review

Successfully navigating the world of free insurance card templates requires a balanced approach, prioritizing both visual appeal and legal compliance. By understanding user needs, leveraging design best practices, and adhering to data privacy regulations, individuals and businesses can create effective and secure templates.

Continuous user feedback and iterative improvements are crucial to ensure the template remains functional, accessible, and compliant with evolving regulations and technological advancements.