Navigating the labyrinth of Florida’s car insurance market can feel like driving through a hurricane. The Sunshine State boasts a unique insurance landscape, shaped by factors like its high population density, frequent weather events, and a unique no-fault insurance system. Understanding these nuances is crucial for Florida residents seeking affordable car insurance.

This comprehensive guide dissects the factors that drive car insurance costs in Florida, offering insights into how to find the cheapest options, explore available discounts, and make informed decisions about coverage. We’ll also delve into Florida’s no-fault law and provide practical tips for navigating the claims process.

Understanding Florida’s Car Insurance Landscape

Florida boasts a unique and complex car insurance landscape, shaped by a confluence of factors that significantly influence costs. Understanding these factors is crucial for consumers seeking affordable coverage.

Factors Influencing Car Insurance Costs

Florida’s car insurance costs are influenced by several factors, including:

- High frequency of accidents: Florida consistently ranks among states with the highest number of car accidents. This high frequency directly impacts insurance premiums as insurers need to account for a greater risk of claims.

- Prevalence of fraud: Florida faces a significant challenge with insurance fraud, particularly in the realm of staged accidents and fake claims. This fraudulent activity increases insurance costs for all drivers as insurers factor in the cost of detecting and combating fraud.

- High property values: Florida’s coastal areas and desirable real estate market contribute to high property values, increasing the potential cost of damage in accidents.

- No-fault insurance system: Florida operates under a no-fault insurance system, meaning drivers must first file claims with their own insurer, regardless of fault. This system can lead to higher premiums as insurers need to cover a wider range of claims.

- Personal Injury Protection (PIP): Florida mandates PIP coverage, which covers medical expenses and lost wages following an accident. The level of PIP coverage, which can vary from $10,000 to $100,000, directly impacts premiums.

- High legal costs: Florida’s legal system is known for its high costs, particularly in personal injury cases. This factor contributes to higher insurance premiums as insurers need to account for the potential for expensive lawsuits.

The Role of the Florida Department of Financial Services

The Florida Department of Financial Services (DFS) plays a critical role in regulating the state’s insurance market. The DFS:

- Licenses and oversees insurance companies: The DFS ensures that insurance companies operating in Florida meet specific financial and operational standards.

- Investigates insurance fraud: The DFS has a dedicated fraud unit that investigates suspected insurance fraud cases, helping to combat this costly problem.

- Protects consumer rights: The DFS provides resources and information to consumers to help them understand their insurance rights and file complaints.

- Sets rates and coverage requirements: The DFS sets minimum coverage requirements and regulates the rates insurance companies can charge.

Florida’s Insurance Market Compared to Other States

Florida’s insurance market differs significantly from other states in several ways:

- Higher premiums: Florida consistently ranks among states with the highest car insurance premiums. This is largely due to the factors discussed above.

- Limited competition: Florida has a more limited number of insurance companies operating in the state compared to other states. This can lead to less competition and potentially higher premiums.

- Unique regulations: Florida has unique regulations and laws governing car insurance, such as the no-fault system and mandatory PIP coverage.

Factors Affecting Car Insurance Premiums

In Florida, car insurance rates are influenced by a complex interplay of factors, each contributing to the overall cost of coverage. Understanding these factors is crucial for drivers to make informed decisions and potentially lower their premiums.

Driving History

A driver’s past driving record is a primary determinant of insurance premiums. A clean driving history with no accidents or violations generally translates into lower premiums. Conversely, drivers with a history of accidents, traffic violations, or DUI convictions will likely face higher premiums. Insurance companies view these incidents as indicators of risk, leading them to charge higher premiums to offset potential claims.

For example, a driver with a recent DUI conviction might see their insurance premiums increase by 50% or more compared to a driver with a clean record.

Age

Age plays a significant role in car insurance rates, as younger drivers are statistically more likely to be involved in accidents. Insurance companies often charge higher premiums for drivers under 25, as they are considered to be less experienced and more prone to risky driving behaviors. However, premiums generally decrease as drivers age and gain more experience.

For instance, a 20-year-old driver might pay significantly higher premiums compared to a 40-year-old driver with a similar driving history.

Vehicle Type

The type of vehicle a driver owns also impacts insurance premiums. Sports cars and luxury vehicles are often considered to be higher risk due to their higher performance capabilities and potential for more expensive repairs.

For example, a driver of a high-performance sports car might pay significantly more for insurance than a driver of a compact sedan.

Location

The geographic location where a driver resides can influence insurance premiums. Areas with higher rates of accidents, theft, or vandalism tend to have higher insurance premiums. Urban areas, for instance, often have higher premiums due to increased traffic density and potential for theft.

For instance, a driver living in a densely populated urban area might pay higher premiums than a driver living in a rural area with less traffic.

Finding Affordable Car Insurance Options

Navigating Florida’s car insurance landscape can be daunting, especially for those seeking the most affordable options. This section provides a step-by-step guide to help Florida residents find the cheapest car insurance rates, empowering them to make informed decisions and potentially save money on their premiums.

Comparing Quotes from Multiple Insurers

Obtaining quotes from various insurance companies is crucial to finding the best rates.

- Use online comparison tools: Numerous websites specialize in comparing car insurance quotes from multiple insurers. These tools streamline the process, allowing you to enter your information once and receive quotes from several companies simultaneously.

- Contact insurance companies directly: Reach out to insurance companies directly to obtain quotes. This approach allows you to ask specific questions and gather detailed information about their coverage options and pricing.

Exploring Discount Opportunities

Insurance companies offer various discounts to reduce premiums.

- Good driving record: Maintaining a clean driving record with no accidents or traffic violations can significantly lower your premiums.

- Safety features: Vehicles equipped with safety features such as anti-theft devices, airbags, and anti-lock brakes often qualify for discounts.

- Bundling policies: Combining your car insurance with other insurance policies, such as homeowners or renters insurance, can lead to substantial savings.

Understanding Coverage Options

Carefully evaluating your insurance coverage needs is essential.

- Liability coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property.

- Collision coverage: This coverage covers repairs or replacement costs for your vehicle if it’s damaged in a collision, regardless of fault.

- Comprehensive coverage: This coverage protects your vehicle against damage from non-collision events, such as theft, vandalism, or natural disasters.

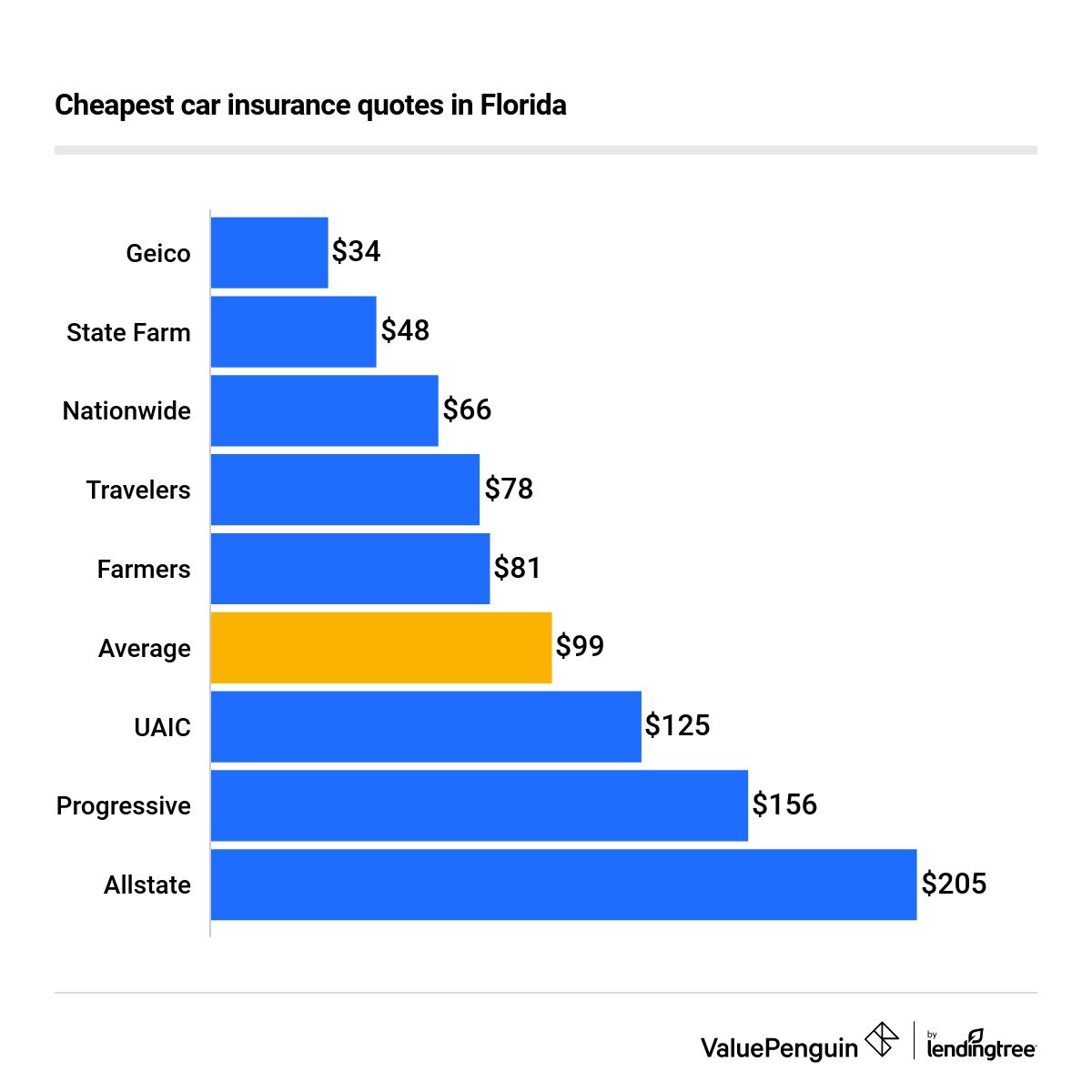

Reputable Insurance Companies in Florida

- State Farm: Offers a wide range of coverage options and discounts, including good driver, safe driver, and bundling discounts.

- Geico: Known for its competitive rates and online convenience. Provides discounts for good drivers, multi-car policies, and military service.

- Progressive: Offers customizable coverage options and discounts for good drivers, safe driving courses, and bundling policies.

- Allstate: Offers a wide range of coverage options, including accident forgiveness and discounts for good drivers, safe driving courses, and bundling policies.

- USAA: Exclusively serves active military personnel, veterans, and their families. Offers competitive rates and discounts for good drivers, safe driving courses, and bundling policies.

Discounts and Savings Strategies

Finding the cheapest car insurance in Florida often involves exploring available discounts. Insurance companies offer a variety of discounts to incentivize safe driving practices, responsible financial behavior, and the use of safety features. By understanding these discounts and strategically utilizing them, you can significantly reduce your car insurance premiums.

Common Discounts in Florida

Discounts are a significant part of the car insurance landscape in Florida. By understanding these discounts and strategically utilizing them, you can significantly reduce your car insurance premiums.

- Good Driver Discount: This is a common discount offered by most insurance companies in Florida. It rewards drivers with a clean driving record, typically without any accidents or traffic violations within a specific timeframe.

- Safe Driver Discount: This discount is similar to the good driver discount but may consider other factors, such as defensive driving courses or accident forgiveness programs.

- Multi-Car Discount: If you insure multiple vehicles with the same insurance company, you can often receive a discount on your premiums.

- Multi-Policy Discount: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can result in a substantial discount.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, can lower your premiums by demonstrating a reduced risk of theft.

- Defensive Driving Course Discount: Completing a certified defensive driving course can demonstrate your commitment to safe driving and potentially earn you a discount.

- Good Student Discount: This discount is typically available to students with good academic records.

- Vehicle Safety Features Discount: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, often qualify for discounts.

Qualifying for Discounts

To qualify for these discounts, you’ll need to meet certain criteria, which can vary depending on the insurance company.

- Safe Driving Records: Maintaining a clean driving record is crucial for securing good driver discounts.

- Bundling Policies: Contact your insurance company to inquire about bundling your car insurance with other policies.

- Vehicle Safety Features: Ensure that your vehicle has the necessary safety features to qualify for the corresponding discount.

Discount Eligibility Criteria

The following table Artikels common discounts, their eligibility criteria, and potential savings:

| Discount | Eligibility Criteria | Potential Savings |

|---|---|---|

| Good Driver Discount | Clean driving record for a specified period | 5-15% |

| Safe Driver Discount | Completion of defensive driving courses or accident forgiveness programs | 5-10% |

| Multi-Car Discount | Insuring multiple vehicles with the same insurance company | 10-20% |

| Multi-Policy Discount | Bundling car insurance with other policies | 10-25% |

| Anti-theft Device Discount | Installation of anti-theft devices | 5-10% |

| Defensive Driving Course Discount | Completion of a certified defensive driving course | 5-10% |

| Good Student Discount | Maintaining good academic standing | 5-10% |

| Vehicle Safety Features Discount | Vehicles equipped with advanced safety features | 5-10% |

Comparing Quotes and Choosing the Right Coverage

Finding the cheapest car insurance in Florida is a multi-step process that requires careful consideration of various factors, including your driving history, vehicle type, and coverage needs. After understanding the landscape, identifying influencing factors, and exploring affordable options, it’s time to compare quotes and choose the right coverage for your specific situation.

Comparing Quotes Effectively

Before comparing quotes, ensure you have all the necessary information, such as your driving history, vehicle details, and desired coverage levels. Then, use a car insurance comparison website or contact multiple insurance providers directly. When comparing quotes, pay attention to the following:

- Deductibles: Higher deductibles generally lead to lower premiums, but you’ll pay more out of pocket if you have to file a claim.

- Coverage Limits: Ensure the coverage limits are sufficient to cover your potential financial liabilities in case of an accident.

- Discounts: Check for available discounts, such as safe driver, good student, multi-car, or bundling discounts.

- Customer Service: Read reviews and consider the provider’s reputation for customer service and claims handling.

Understanding Coverage Types and Limits

Florida’s minimum car insurance requirements include:

- Personal Injury Protection (PIP): Covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault.

- Property Damage Liability (PDL): Covers damages to another person’s property if you are at fault in an accident.

While these are the minimum requirements, it’s highly recommended to consider additional coverage options like:

- Collision Coverage: Covers damages to your vehicle in an accident, regardless of fault.

- Comprehensive Coverage: Covers damages to your vehicle from events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): Protects you if you are involved in an accident with a driver who has no or insufficient insurance.

Determining the Right Coverage Level

The right level of coverage depends on your individual needs and financial situation. Here are some factors to consider:

- Vehicle Value: If your vehicle is newer or more expensive, consider comprehensive and collision coverage.

- Driving History: A clean driving record might allow you to reduce coverage levels.

- Financial Situation: Your ability to pay for out-of-pocket expenses in case of an accident should be factored in when choosing deductibles and coverage limits.

Tip: Consult with an insurance agent to discuss your specific needs and get personalized recommendations for coverage levels and deductibles.

Tips for Saving on Car Insurance

In Florida, car insurance premiums can vary significantly, and finding ways to lower your costs is crucial. Here are some strategies to help you save on your car insurance premiums:

Improving Driving Habits

Safe driving habits are essential for keeping your insurance premiums low. By avoiding accidents and traffic violations, you demonstrate to insurance companies that you are a responsible driver, making you a less risky customer.

- Defensive Driving Courses: Enrolling in a defensive driving course can help you learn techniques for safer driving and may qualify you for discounts on your insurance premiums.

- Avoid Distracted Driving: Distracted driving is a major cause of accidents. Put away your phone and avoid other distractions while driving.

- Maintain a Clean Driving Record: Avoid speeding tickets, DUI convictions, and other traffic violations. A clean driving record is a significant factor in determining your insurance premiums.

Maintaining a Good Credit Score

Surprisingly, your credit score can influence your car insurance premiums. Insurance companies often use credit scores to assess risk, as people with good credit are generally considered more financially responsible.

- Check Your Credit Score Regularly: Monitor your credit score for errors and take steps to improve it if necessary.

- Pay Bills on Time: Make all payments on time to maintain a good credit history.

- Limit Credit Applications: Excessive credit applications can negatively impact your credit score.

Shopping Around for Better Rates

Comparing quotes from multiple insurance companies is essential for finding the best rates. Insurance companies use different algorithms to calculate premiums, so you might find significantly lower rates with one company compared to another.

- Use Online Comparison Tools: Several websites allow you to compare quotes from various insurance companies quickly and easily.

- Contact Insurance Agents Directly: Reach out to insurance agents to get personalized quotes and discuss your coverage needs.

- Negotiate Your Premiums: Once you have received quotes from different companies, don’t hesitate to negotiate for a better rate.

Understanding Florida’s No-Fault Law

Florida operates under a “no-fault” insurance system, meaning that drivers are primarily responsible for covering their own medical expenses and lost wages after an accident, regardless of who caused it. This system aims to simplify the claims process and reduce litigation.

Personal Injury Protection (PIP) Coverage

Florida requires all drivers to carry Personal Injury Protection (PIP) coverage, which pays for medical expenses and lost wages for the insured and their passengers, up to a certain limit. PIP benefits are typically limited to $10,000 per person for medical expenses and $5,000 for lost wages. This coverage applies regardless of who is at fault for the accident.

Filing Claims Under Florida’s No-Fault System

When an accident occurs in Florida, the driver involved must file a claim with their own insurance company, regardless of who caused the accident. The driver’s PIP coverage will cover their medical expenses and lost wages, up to the policy limits.

If the driver’s injuries exceed their PIP coverage, they may be able to file a claim against the at-fault driver’s insurance company for additional compensation.

Navigating Car Insurance Claims

In the unfortunate event of an accident, understanding the car insurance claims process in Florida is crucial. Knowing your rights and responsibilities can ensure a smooth and successful claim resolution.

Steps Involved in Filing a Car Insurance Claim

The claims process begins with promptly reporting the accident to your insurance company. This is typically done by phone, online, or through a mobile app. You’ll need to provide details about the accident, including the date, time, location, and any injuries sustained.

- Report the Accident: Contact your insurance company immediately to report the accident. Provide them with all the relevant details, including the date, time, location, and any injuries.

- File a Claim: Once you’ve reported the accident, your insurance company will guide you through the claim filing process. This usually involves completing a claim form and providing supporting documentation.

- Investigate the Claim: Your insurance company will investigate the claim to determine the cause of the accident and assess the extent of the damage. They may request additional information or documentation from you.

- Negotiate a Settlement: Once the investigation is complete, your insurance company will make a settlement offer. You have the right to negotiate this offer, and you can consult with an attorney if you feel it’s not fair.

- Receive Payment: If you accept the settlement offer, your insurance company will issue payment for the covered damages. The payment may be made directly to you or to the repair shop or other service provider.

Documenting the Accident and Gathering Evidence

Thorough documentation is essential for a successful claim. After ensuring safety, take the following steps:

- Exchange Information: Obtain the other driver’s name, address, phone number, insurance company, and policy number.

- Take Photos: Document the accident scene, including damage to vehicles, injuries, and any road signs or traffic signals.

- Get Witness Statements: If there were witnesses to the accident, obtain their names and contact information.

- Seek Medical Attention: If you or anyone else is injured, seek immediate medical attention and keep detailed records of your treatment.

Understanding the Claims Process and Communicating Effectively

Clear communication with your insurance provider is vital throughout the claims process. Be prepared to answer their questions thoroughly and honestly, and keep detailed records of all communications.

- Understand Your Policy: Review your insurance policy carefully to understand your coverage and limitations. This will help you know what to expect during the claims process.

- Communicate Clearly: Be clear and concise in your communication with your insurance company. Provide accurate information and keep detailed records of all conversations and correspondence.

- Be Patient: The claims process can take time, so be patient and persistent in following up with your insurance company.

Resources and Additional Information

Navigating Florida’s car insurance landscape can be complex, and having access to the right resources can make the process smoother. This section provides links to official websites, contact information for consumer protection agencies, and insurance advocacy groups, all of which can offer valuable guidance and support.

Official Websites and Resources

The Florida Department of Financial Services (DFS) is the primary regulatory body for insurance in Florida. Their website offers a wealth of information on car insurance, including consumer guides, FAQs, and complaint filing procedures.

- Florida Department of Financial Services: https://www.fldfs.com/

The Florida Office of Insurance Regulation (OIR) is responsible for overseeing the insurance industry and ensuring fair and competitive practices. Their website provides information on insurance rates, consumer rights, and complaint resolution processes.

- Florida Office of Insurance Regulation: https://www.floir.com/

Consumer Protection Agencies and Advocacy Groups

Several consumer protection agencies and advocacy groups specialize in helping Floridians with insurance-related issues. These organizations can provide guidance, support, and resources for navigating complex insurance matters.

- Florida Consumer Helpline: https://www.myfloridalegal.com/contact-us/

- Florida Insurance Consumer Advocate: https://www.myfloridalegal.com/insurance/

- National Association of Insurance Commissioners (NAIC): https://www.naic.org/

Key Contact Details and Resources

| Resource | Contact Information |

|———————————————|—————————————————————–|

| Florida Department of Financial Services | https://www.fldfs.com/ |

| Florida Office of Insurance Regulation | https://www.floir.com/ |

| Florida Consumer Helpline | https://www.myfloridalegal.com/contact-us/ |

| Florida Insurance Consumer Advocate | https://www.myfloridalegal.com/insurance/ |

| National Association of Insurance Commissioners | https://www.naic.org/ |

Closure

Finding the cheapest car insurance in Florida requires a strategic approach. By understanding the factors that influence premiums, comparing quotes from multiple providers, and leveraging available discounts, Florida residents can secure affordable coverage that meets their individual needs. Remember, proactive research and careful planning are key to navigating this complex market and achieving significant savings on your car insurance.