The cost of car insurance can be a significant financial burden, especially for those on a tight budget. Finding cheap car insurance is a common goal, but it’s crucial to balance affordability with adequate coverage. This guide will delve into the factors that influence car insurance premiums, explore strategies for finding affordable rates, and shed light on the importance of understanding your policy documents.

We’ll also discuss the role of technology in the car insurance landscape and provide insights into how safe driving practices can lead to discounts. By understanding the intricacies of car insurance, you can make informed decisions and secure the best possible coverage for your needs without breaking the bank.

Understanding the Need for Cheap Car Insurance

In today’s economy, where every dollar counts, finding affordable car insurance is a top priority for many individuals. The rising cost of living, coupled with the need for reliable transportation, makes it essential to secure adequate coverage without breaking the bank.

Factors Influencing Car Insurance Costs

Numerous factors contribute to the cost of car insurance. Understanding these factors is crucial for individuals seeking cheap car insurance.

- Vehicle Type: The make, model, and year of your vehicle significantly impact your insurance premiums. High-performance cars, luxury vehicles, and those with a history of theft or accidents tend to be more expensive to insure.

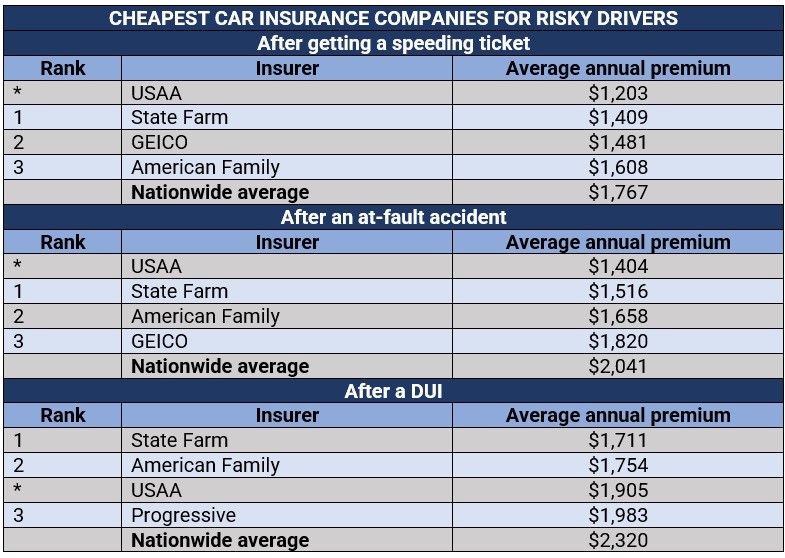

- Driving History: Your driving record plays a vital role in determining your insurance rates. Accidents, speeding tickets, and other traffic violations can lead to higher premiums.

- Location: The area where you reside influences insurance costs. Densely populated urban areas with high traffic volume and crime rates often have higher insurance premiums compared to rural areas.

- Age and Gender: Younger drivers, particularly those under 25, generally face higher insurance rates due to their higher risk of accidents. Gender also plays a role, with men typically paying more than women.

- Coverage Levels: The type and amount of coverage you choose affect your premiums. Comprehensive and collision coverage, while providing greater protection, come with higher costs.

- Credit Score: In some states, insurers use credit scores as a factor in determining insurance rates. Individuals with lower credit scores may face higher premiums.

Demographics of Individuals Seeking Cheap Car Insurance

The need for affordable car insurance is felt across various demographics, with certain groups seeking it more actively.

- Young Adults: Young drivers, particularly those with limited driving experience, often face high insurance premiums. They are more likely to seek out affordable options to manage their budgets.

- Low-Income Households: Individuals and families with limited financial resources may prioritize affordability over extensive coverage. They are more likely to seek out cheaper insurance plans to fit their budgets.

- Students: Students, especially those attending college or university, often rely on used cars and may seek affordable insurance options to manage their expenses.

- Seniors: Seniors on fixed incomes may also seek affordable insurance options to ensure they can afford coverage while maintaining their transportation needs.

Importance of Finding Affordable Insurance While Maintaining Adequate Coverage

While finding cheap car insurance is important, it is equally crucial to ensure adequate coverage.

Maintaining the right balance between affordability and coverage is essential. You want to find a plan that fits your budget but also provides sufficient protection in case of an accident.

Factors Influencing Car Insurance Premiums

Car insurance premiums are influenced by a complex interplay of factors, each contributing to the overall cost. These factors reflect the insurer’s assessment of the risk associated with insuring a particular driver, vehicle, and location.

Driving History

A driver’s history is a significant factor in determining insurance premiums. A clean driving record with no accidents or traffic violations translates into lower premiums, as insurers perceive such drivers as less risky. Conversely, a history of accidents, speeding tickets, or DUI convictions will increase premiums. The severity and frequency of past incidents are also considered.

For example, a driver with a recent DUI conviction might face a premium increase of 20-30% compared to a driver with a clean record.

Vehicle Type

The type of vehicle you drive plays a crucial role in determining insurance costs. Factors such as make, model, year, safety features, and engine size are considered. Vehicles with high repair costs, a history of frequent accidents, or a high theft rate tend to have higher insurance premiums.

Sports cars, luxury vehicles, and high-performance models are generally more expensive to insure due to their higher repair costs and potential for greater damage in an accident.

Location

Your location significantly impacts your car insurance premiums. Factors such as population density, traffic congestion, crime rates, and weather conditions influence the risk of accidents. Urban areas with high traffic volumes and congested roads typically have higher insurance rates than rural areas.

For instance, drivers in major cities like New York City or Los Angeles often face higher premiums compared to those in smaller towns or rural areas.

Coverage Levels

The level of coverage you choose for your car insurance also influences the premium. Higher coverage levels, such as comprehensive and collision coverage, provide more protection but come with higher premiums. Basic liability coverage, which only covers damages to others, is generally the most affordable option.

A driver opting for comprehensive and collision coverage, which covers damage to their own vehicle in accidents or due to incidents like theft or vandalism, will pay a higher premium than someone with only liability coverage.

| Factor | Impact on Premium |

|---|---|

| Driving History | Significant, higher premiums for drivers with accidents or violations |

| Vehicle Type | Significant, higher premiums for vehicles with high repair costs or theft risk |

| Location | Significant, higher premiums in urban areas with high traffic and crime |

| Coverage Levels | Significant, higher premiums for higher coverage levels |

Strategies for Finding Affordable Car Insurance

Finding the cheapest car insurance policy requires a proactive approach and careful consideration of various factors. By implementing strategic steps and leveraging available resources, individuals can significantly reduce their insurance premiums and secure affordable coverage.

Comparing Quotes from Multiple Insurers

Obtaining quotes from multiple insurers is a fundamental step in finding cheap car insurance. This allows you to compare prices, coverage options, and policy features to identify the most suitable and affordable option.

- Utilize online comparison websites: Websites such as Compare.com, Bankrate, and NerdWallet allow you to enter your details and receive quotes from multiple insurers simultaneously. These platforms streamline the comparison process, saving you time and effort.

- Contact insurers directly: Reach out to insurance companies directly to obtain quotes. This approach allows you to discuss specific coverage needs and negotiate potential discounts.

- Consider different types of insurers: Explore quotes from both traditional insurance companies and online-only insurers. Online insurers often offer lower premiums due to their lower overhead costs.

Negotiating with Insurers

Negotiating with insurers can help you secure a more favorable price for your car insurance. By leveraging your knowledge and negotiation skills, you can potentially lower your premiums.

- Shop around for better deals: After receiving initial quotes, contact other insurers and inform them of the rates you have received. This can incentivize them to offer a more competitive price to secure your business.

- Bundle your insurance policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts.

- Discuss your driving record and risk factors: Highlight your clean driving record and any safety features in your car to demonstrate your low-risk profile. This can influence insurers to offer a lower premium.

Exploring Discounts and Saving Opportunities

Insurers offer various discounts to incentivize safe driving habits and customer loyalty. By understanding and leveraging these discounts, you can significantly reduce your insurance premiums.

- Good student discounts: Students with good academic performance may qualify for discounts. This demonstrates responsible behavior and a lower risk profile.

- Safe driver discounts: Maintaining a clean driving record with no accidents or violations can earn you significant discounts.

- Anti-theft device discounts: Installing anti-theft devices, such as alarm systems or GPS trackers, can reduce the risk of theft and qualify you for discounts.

- Loyalty discounts: Insurers often reward long-term customers with discounts for their continued business.

- Pay-in-full discounts: Paying your annual premium in full can result in a discount, as it eliminates the need for installment payments and associated administrative costs.

- Consider higher deductibles: Choosing a higher deductible can lower your premium. However, it is important to ensure you can afford to pay the deductible in case of an accident.

Types of Car Insurance Coverage and Their Cost

Car insurance provides financial protection against potential risks associated with owning and operating a vehicle. Understanding the different types of coverage and their associated costs is crucial for making informed decisions about your insurance needs.

Coverage Types and Their Costs

The cost of car insurance varies depending on the type of coverage you choose, your driving record, the type of vehicle you own, and your location. Here’s a breakdown of the most common types of coverage:

Liability Coverage

Liability coverage is the most basic type of car insurance and is usually required by law. It protects you financially if you are at fault in an accident that causes injury or damage to others.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages caused to others if you are at fault in an accident. The amount of coverage is typically expressed as a limit per person and a limit per accident.

- Property Damage Liability: This coverage pays for damages to other people’s property, such as their vehicle or other property, if you are at fault in an accident. The amount of coverage is typically expressed as a single limit per accident.

Collision Coverage

Collision coverage pays for damages to your vehicle if it is involved in an accident, regardless of who is at fault. It is optional, but it is often recommended for newer vehicles or vehicles with a high loan balance.

Comprehensive Coverage

Comprehensive coverage pays for damages to your vehicle caused by events other than an accident, such as theft, vandalism, fire, or natural disasters. This coverage is also optional, but it is often recommended for newer vehicles or vehicles with a high loan balance.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who is uninsured or has insufficient insurance. It pays for your medical expenses, lost wages, and other damages.

Personal Injury Protection (PIP)

PIP coverage, also known as no-fault insurance, pays for your medical expenses and lost wages, regardless of who is at fault in an accident. It is mandatory in some states.

Other Coverages

Other types of car insurance coverage include:

- Rental Car Coverage: This coverage pays for the cost of a rental car if your vehicle is damaged or stolen.

- Towing and Labor Coverage: This coverage pays for the cost of towing and labor if your vehicle breaks down.

- Roadside Assistance: This coverage provides assistance for emergencies such as flat tires, dead batteries, and lockouts.

Coverage Levels

Insurance companies offer different coverage levels, which affect the cost of your premiums. Higher coverage limits generally result in higher premiums. For example, a higher bodily injury liability limit will cost more than a lower limit.

Cost Comparison

The cost of car insurance varies widely among insurance companies. To get the best rate, it is essential to compare quotes from multiple insurers. You can use online comparison tools or contact insurance agents directly.

Typical Costs

The table below illustrates the typical costs associated with each coverage type and the benefits they provide.

| Coverage Type | Typical Cost | Benefits |

|---|---|---|

| Liability Coverage | $200 – $500 per year | Protects you financially if you are at fault in an accident that causes injury or damage to others. |

| Collision Coverage | $200 – $600 per year | Pays for damages to your vehicle if it is involved in an accident, regardless of who is at fault. |

| Comprehensive Coverage | $100 – $300 per year | Pays for damages to your vehicle caused by events other than an accident, such as theft, vandalism, fire, or natural disasters. |

| Uninsured/Underinsured Motorist Coverage | $50 – $150 per year | Protects you if you are involved in an accident with a driver who is uninsured or has insufficient insurance. |

| Personal Injury Protection (PIP) | $50 – $200 per year | Pays for your medical expenses and lost wages, regardless of who is at fault in an accident. |

“The cost of car insurance can vary significantly depending on your individual circumstances, so it’s important to shop around and compare quotes from multiple insurers.”

Online Car Insurance Comparison Tools

In today’s digital age, comparing car insurance quotes has become easier than ever before. Online car insurance comparison tools have revolutionized the way consumers shop for insurance, providing a convenient and efficient way to find the best deals. These tools allow users to compare quotes from multiple insurers simultaneously, saving time and effort.

Advantages and Disadvantages of Online Car Insurance Comparison Tools

Online car insurance comparison tools offer several advantages, including:

- Convenience: Users can compare quotes from the comfort of their homes or on the go, without the need for phone calls or in-person visits.

- Time-saving: These tools streamline the quote process, eliminating the need to contact multiple insurers individually.

- Transparency: Users can see the coverage options and prices from different insurers side-by-side, enabling informed decision-making.

- Potential for Savings: By comparing quotes, users can often find lower premiums than they would have obtained by contacting insurers directly.

However, online car insurance comparison tools also have some disadvantages:

- Limited Customization: These tools may not always provide the full range of coverage options available from each insurer, potentially limiting customization.

- Data Privacy Concerns: Users should be aware of the data they share with these tools and ensure their privacy is protected.

- Potential for Bias: Some tools may prioritize certain insurers over others, potentially influencing the results.

- Lack of Personal Interaction: Users may miss out on the personalized advice and support that can be obtained from an insurance agent.

Features and Functionality of Online Car Insurance Comparison Tools

Online car insurance comparison tools offer a variety of features and functionalities, with some of the most common ones including:

- Quote Comparison: This core functionality allows users to enter their information and compare quotes from multiple insurers simultaneously.

- Coverage Options: Tools typically offer a range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Discounts: Many tools highlight potential discounts, such as safe driver discounts, good student discounts, and multi-car discounts.

- Policy Management: Some tools allow users to manage their existing policies, such as making payments or updating contact information.

- Customer Reviews: Some platforms may include customer reviews of different insurance companies, providing insights into customer satisfaction.

Effective Use of Online Car Insurance Comparison Tools

To maximize the benefits of online car insurance comparison tools, users should:

- Provide Accurate Information: Ensure that the information entered is accurate and complete to receive accurate quotes.

- Compare Multiple Tools: Use several comparison tools to ensure a comprehensive overview of available options.

- Read the Fine Print: Carefully review the policy details, including coverage limits, deductibles, and exclusions, before making a decision.

- Consider Your Needs: Choose a policy that meets your specific needs and budget.

- Verify Information: Confirm the information provided by the comparison tool with the insurance company before making a purchase.

Importance of Reading Policy Documents

Your car insurance policy is a legally binding contract, and understanding its terms is crucial to ensure you are adequately protected and avoid any unpleasant surprises. Thoroughly reading and understanding your policy document is essential, not just to ensure you have the coverage you need, but also to avoid potential misunderstandings or disputes later on.

Key Terms and Clauses to Pay Attention To

It’s vital to familiarize yourself with key terms and clauses within your policy document. These terms define the scope of your coverage and your responsibilities as the policyholder.

- Deductible: This is the amount you pay out-of-pocket for covered repairs or losses before your insurance kicks in. A higher deductible generally leads to lower premiums, while a lower deductible means higher premiums.

- Coverage Limits: These limits specify the maximum amount your insurance will pay for specific types of claims, such as bodily injury liability or property damage liability. Understanding these limits ensures you have sufficient coverage for potential liabilities.

- Exclusions: These are situations or circumstances where your insurance coverage may not apply. It’s crucial to be aware of these exclusions to avoid any surprises when you need to file a claim.

- Renewal Provisions: These provisions Artikel the terms for renewing your policy, including premium adjustments, renewal deadlines, and potential changes to coverage.

- Cancellation Policy: This section Artikels the process for canceling your policy, including any associated penalties or refunds.

Essential Points to Consider Before Signing Up

Before signing up for car insurance, consider the following checklist to ensure you are making an informed decision:

- Compare Quotes: Obtain quotes from multiple insurance providers to compare premiums and coverage options.

- Review Coverage Options: Carefully review the different coverage options available, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Understand Deductibles: Determine the deductible you are comfortable with, balancing cost savings with your financial capacity to cover out-of-pocket expenses.

- Consider Discounts: Explore available discounts, such as safe driving discounts, multi-car discounts, or good student discounts.

- Read the Policy Carefully: Don’t hesitate to ask questions about anything you don’t understand.

Safe Driving Practices and Discounts

Safe driving habits are not only essential for your own safety and the safety of others on the road but can also lead to significant savings on your car insurance premiums. Insurance companies often reward drivers with good driving records and those who take proactive steps to reduce their risk on the road.

Discounts for Good Driving Records

Insurance companies recognize and reward drivers with a history of safe driving. A clean driving record, free from accidents, violations, or traffic tickets, is a key factor in qualifying for substantial discounts. These discounts can vary significantly depending on the insurer, your driving history, and the specific state you reside in.

For instance, a driver with a spotless record for five years might qualify for a discount of up to 20% on their car insurance premiums.

Discounts for Safety Features

Modern vehicles are equipped with an array of safety features designed to prevent accidents and mitigate their severity. Insurance companies recognize the value of these features and offer discounts to drivers who own vehicles with advanced safety technologies.

- Anti-lock Braking Systems (ABS): ABS helps drivers maintain control of their vehicle during emergency braking situations, reducing the risk of skidding and accidents.

- Electronic Stability Control (ESC): ESC helps drivers maintain control of their vehicle during challenging maneuvers, such as sharp turns or slippery road conditions.

- Airbags: Airbags provide an extra layer of protection for drivers and passengers in the event of a collision.

- Backup Cameras: Backup cameras help drivers see behind their vehicle, reducing the risk of accidents when backing up.

- Lane Departure Warning Systems: Lane departure warning systems alert drivers if they drift out of their lane, helping to prevent accidents.

Discounts for Driver Training Courses

Driver training courses, especially those focused on defensive driving techniques, are often recognized by insurance companies as a sign of a responsible driver. These courses can teach drivers how to anticipate potential hazards, make safe driving decisions, and avoid accidents.

- Defensive Driving Courses: These courses teach drivers how to anticipate potential hazards, make safe driving decisions, and avoid accidents.

- Advanced Driving Courses: These courses provide more in-depth training on driving techniques, including handling challenging road conditions and emergency maneuvers.

Insurance companies often offer discounts of up to 10% for completing a certified driver training course.

Insurance Companies Offering Affordable Rates

Finding the right car insurance company can be a daunting task, especially when you’re looking for the most affordable rates. There are numerous insurance providers out there, each with its own unique offerings and pricing structures. Navigating this complex landscape requires careful research and a clear understanding of your individual needs.

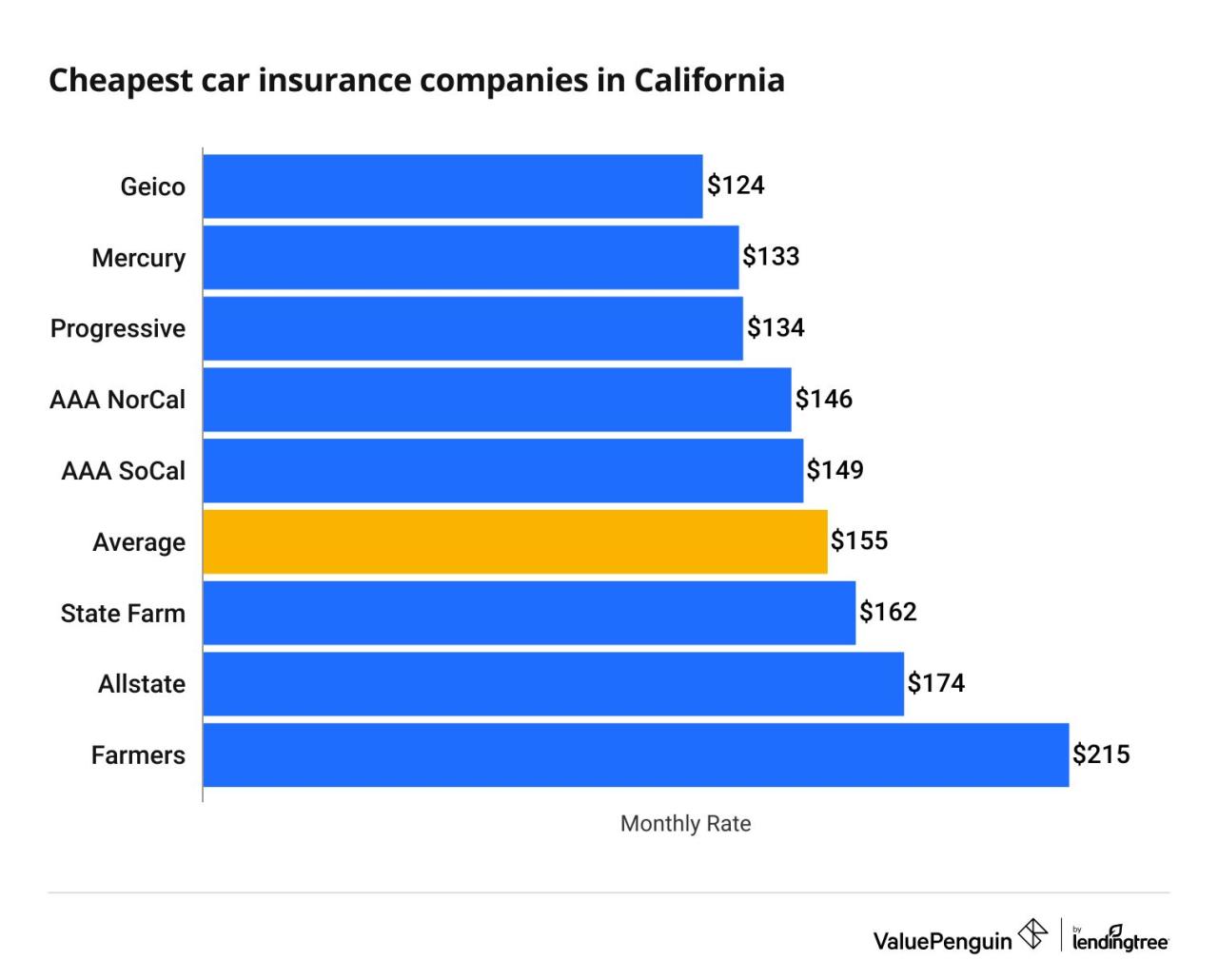

Reputable Insurance Companies with Competitive Rates

Choosing a reputable insurance company is crucial, as it ensures you’re protected and receive excellent customer service. Here are some companies known for their competitive rates and strong track records:

- Geico: Geico consistently ranks among the most affordable car insurance providers. It’s known for its straightforward policies, online convenience, and extensive discount options. Geico’s customer service has received generally positive reviews. The company’s financial stability is strong, with a high A.M. Best rating.

- State Farm: State Farm is a long-standing insurance giant with a strong reputation for customer service. It offers a wide range of coverage options and discounts, making it a viable choice for many drivers. State Farm’s financial stability is exceptional, with a top A.M. Best rating.

- Progressive: Progressive is known for its innovative approach to car insurance, including its popular “Name Your Price” tool. It offers competitive rates and a wide range of coverage options. Progressive’s customer service has received mixed reviews, but its financial stability is solid with a high A.M. Best rating.

- USAA: USAA exclusively serves military personnel, veterans, and their families. It’s renowned for its exceptional customer service, competitive rates, and financial strength. USAA’s A.M. Best rating is excellent, reflecting its strong financial standing.

- Liberty Mutual: Liberty Mutual offers a range of coverage options and discounts, including its “RightTrack” program that rewards safe driving. It has a good reputation for customer service and a solid A.M. Best rating.

Comparing Coverage Options, Customer Service, and Financial Stability

When comparing insurance companies, it’s essential to consider factors beyond just price.

- Coverage Options: Different companies offer varying levels of coverage. Make sure to compare the coverage options, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage, to ensure you’re adequately protected.

- Customer Service: Evaluate the company’s customer service reputation. Consider factors such as responsiveness, accessibility, and ease of filing claims. Look for online reviews and ratings to gauge the company’s customer satisfaction.

- Financial Stability: A financially stable insurance company is essential to ensure you’ll be covered in case of a major claim. Check the company’s A.M. Best rating, which reflects its financial strength and ability to pay claims.

Detailed Overview of Each Company’s Strengths and Weaknesses

Each insurance company has its own strengths and weaknesses. It’s crucial to weigh these factors against your individual needs and preferences:

Geico

- Strengths: Competitive rates, straightforward policies, online convenience, extensive discount options, good customer service, strong financial stability.

- Weaknesses: Limited availability in some areas, customer service may not be as personalized as other companies.

State Farm

- Strengths: Strong reputation, wide range of coverage options, extensive discount options, excellent customer service, exceptional financial stability.

- Weaknesses: Rates may not always be the most competitive, may not be as innovative as some other companies.

Progressive

- Strengths: Innovative approach, competitive rates, wide range of coverage options, “Name Your Price” tool, good financial stability.

- Weaknesses: Customer service has received mixed reviews, may not be as well-known for its customer service as other companies.

USAA

- Strengths: Exceptional customer service, competitive rates, strong financial stability, exclusive service for military personnel, veterans, and their families.

- Weaknesses: Limited availability to only military personnel, veterans, and their families.

Liberty Mutual

- Strengths: Wide range of coverage options, discounts, “RightTrack” program, good customer service, solid financial stability.

- Weaknesses: Rates may not always be the most competitive, may not be as well-known as other companies.

The Role of Technology in Car Insurance

The insurance industry is undergoing a rapid transformation driven by technological advancements. These innovations are revolutionizing how car insurance is priced, purchased, and even claimed.

Impact of Telematics and Usage-Based Insurance

Telematics, the use of technology to collect and analyze data from vehicles, is fundamentally changing the car insurance landscape. Usage-based insurance (UBI) programs leverage telematics to monitor driving habits, such as speed, braking, mileage, and time of day, to create personalized insurance premiums.

- Personalized Pricing: UBI programs offer lower premiums to drivers with safer driving habits. This personalized pricing model incentivizes safe driving and rewards responsible behavior.

- Real-time Risk Assessment: Telematics devices continuously monitor driving patterns, providing insurers with real-time data to assess risk more accurately. This dynamic approach allows for more precise and equitable pricing.

- Enhanced Coverage: Some UBI programs offer additional coverage, such as roadside assistance or crash detection, based on driving behavior.

Benefits of Technological Advancements

- Increased Accuracy and Transparency: Telematics data provides a more accurate picture of individual driving behavior, leading to fairer and more transparent insurance premiums.

- Improved Safety: UBI programs encourage safer driving habits by rewarding good behavior. This can lead to a reduction in accidents and injuries on the road.

- Personalized Services: Technology allows insurers to offer customized services tailored to individual needs, such as telematics-based driver coaching or on-demand insurance coverage.

Challenges of Technological Advancements

- Privacy Concerns: The collection and use of telematics data raise concerns about privacy and data security.

- Technological Barriers: Not all drivers have access to the necessary technology for UBI programs, creating potential inequities in pricing and coverage.

- Complexity and Understanding: UBI programs can be complex and difficult for some drivers to understand, leading to confusion and potential frustration.

Concluding Remarks

In today’s competitive car insurance market, finding cheap car insurance is more attainable than ever. By taking the time to compare quotes, explore discounts, and understand your policy, you can secure affordable coverage that provides peace of mind. Remember, the key to finding the best deal is to be informed, proactive, and diligent in your search. Don’t settle for the first offer you receive – take the time to compare and choose the policy that best suits your individual needs and budget.