Navigating the world of health insurance can be a daunting task, especially when faced with acronyms like PPO. What does PPO stand for in insurance, and how does it work? Understanding the ins and outs of PPO plans is crucial for making informed decisions about your healthcare coverage. This comprehensive guide will demystify PPO insurance, exploring its features, benefits, drawbacks, and how it compares to other popular health insurance options.

PPO, short for Preferred Provider Organization, is a type of health insurance plan that offers flexibility in choosing healthcare providers while maintaining a network of preferred providers. PPO plans typically involve higher premiums than other plans but offer greater choice and potentially lower out-of-pocket costs for in-network services. This guide will delve deeper into the specifics of PPO insurance, examining its key features, advantages, disadvantages, and how it fits into the broader landscape of health insurance options.

What PPO Stands For

PPO stands for Preferred Provider Organization. It is a type of health insurance plan that offers a network of healthcare providers, such as doctors, hospitals, and other medical professionals, that have agreed to provide services at a discounted rate to plan members.

PPO Insurance Explained

PPO insurance is a type of managed care plan that gives you the flexibility to choose your healthcare providers, both within and outside the network. However, you’ll typically pay lower out-of-pocket costs if you use in-network providers.

How PPO Insurance Works

PPO insurance, or Preferred Provider Organization insurance, is a type of health insurance plan that offers flexibility and choice in accessing healthcare services. It provides a network of healthcare providers, but you are not limited to using only those providers. You can choose to see a doctor or specialist outside the network, but you will typically pay a higher out-of-pocket cost.

Here’s a step-by-step explanation of how PPO insurance operates:

Choosing a PPO Plan

When you select a PPO plan, you’ll typically choose a plan based on your individual needs and budget. Factors to consider include the network size, coverage options, and monthly premiums.

Accessing Healthcare Services

With a PPO plan, you can choose to see doctors and specialists within the network or outside the network. Seeing a provider within the network generally results in lower out-of-pocket costs. However, you have the flexibility to seek care from providers outside the network if you prefer.

Paying for Healthcare Services

PPO plans usually have a co-pay or co-insurance structure. A co-pay is a fixed amount you pay for each service, while co-insurance is a percentage of the cost you pay.

For example, you might have a $20 co-pay for a doctor’s visit and an 80/20 co-insurance for surgeries, where you pay 20% of the cost.

The Role of Providers and Networks

PPO plans are based on a network of healthcare providers who have negotiated discounted rates with the insurance company. These providers are typically doctors, specialists, hospitals, and other healthcare facilities. The network size can vary depending on the plan, with some plans offering wider networks than others.

Benefits of PPO Insurance

PPO insurance offers several benefits, including:

- Flexibility: PPO plans provide flexibility in choosing healthcare providers, both within and outside the network.

- Wide Network: PPO plans generally have a large network of providers, offering a wide range of choices.

- No Gatekeeper: Unlike HMOs, PPO plans don’t require referrals for specialists.

Considerations for PPO Insurance

While PPO plans offer flexibility, there are also some considerations:

- Higher Premiums: PPO plans may have higher monthly premiums compared to HMOs.

- Higher Out-of-Pocket Costs: You may have higher out-of-pocket costs when seeing providers outside the network.

Key Features of PPO Plans

PPO plans, or Preferred Provider Organizations, offer a balance between cost-effectiveness and flexibility. They provide access to a broad network of healthcare providers while allowing out-of-network options, albeit with higher costs.

Deductibles and Copayments

Deductibles and copayments are crucial elements of PPO plans that influence the financial burden of healthcare services.

- A deductible is a fixed amount you must pay out-of-pocket before your insurance coverage kicks in. Once you meet your deductible, your insurance company starts covering a portion of your medical expenses. Deductibles vary depending on the PPO plan you choose.

- A copayment, also known as a copay, is a fixed amount you pay for specific medical services, such as doctor’s visits or prescriptions. Copayments are usually lower than deductibles and are paid regardless of whether you’ve met your deductible.

For example, you might have a $1,000 deductible and a $20 copay for doctor’s visits. If you incur $1,200 in medical expenses, you would pay the first $1,000 as your deductible. Then, your insurance company would cover the remaining $200. For each doctor’s visit, you would pay a $20 copay, regardless of whether you’ve met your deductible.

In-Network and Out-of-Network Providers

PPO plans offer a network of healthcare providers that have agreed to discounted rates with the insurance company. These are known as in-network providers.

- Using in-network providers generally results in lower out-of-pocket costs, as your insurance company negotiates lower rates with these providers.

- However, you also have the option to see out-of-network providers, who are not part of the PPO’s network. While this offers greater flexibility, it typically comes with higher costs. You’ll likely pay a higher percentage of the medical expenses, and your insurance company might not cover all of the charges.

It’s essential to check your PPO plan’s details to understand the specific coverage and costs associated with both in-network and out-of-network providers.

Benefits of PPO Insurance

PPO insurance plans offer a range of advantages that can significantly benefit individuals and families seeking comprehensive healthcare coverage. PPO plans provide flexibility in healthcare choices, access to a wide network of providers, and financial protection against high medical costs.

Flexibility in Healthcare Choices

PPO plans allow individuals to choose their healthcare providers, including specialists, without needing referrals. This flexibility empowers individuals to select doctors they trust and feel comfortable with, fostering a more personalized healthcare experience.

Wide Network of Providers

PPO plans typically have extensive provider networks, offering access to a wide range of healthcare professionals, including doctors, hospitals, and specialists. This broad network ensures individuals can find providers conveniently located near their homes or workplaces.

Financial Protection

PPO plans provide financial protection by covering a significant portion of medical expenses. They typically have lower copayments and deductibles compared to other plans, reducing out-of-pocket costs for routine and specialized care.

Examples of PPO Insurance Benefits

Consider the following scenarios where PPO insurance proves beneficial:

- A patient with a chronic condition requiring regular specialist visits can choose a preferred specialist within the PPO network, ensuring continuity of care and potentially lower out-of-pocket expenses.

- An individual seeking a second opinion for a medical diagnosis can consult with a different specialist within the PPO network without needing a referral, allowing for a more informed decision.

- A family experiencing a medical emergency can access care at a nearby hospital within the PPO network, reducing the stress of finding an in-network facility during a critical situation.

Drawbacks of PPO Insurance

While PPO plans offer several benefits, it’s crucial to understand their potential downsides. These limitations can significantly impact your healthcare expenses and overall experience.

Higher Premiums

PPO plans often come with higher premiums compared to HMO plans. This is because PPOs provide greater flexibility and access to a broader network of healthcare providers, which translates to higher administrative costs for insurance companies. For example, a PPO plan may have a monthly premium of $500, while a comparable HMO plan might cost $400.

Higher Out-of-Pocket Expenses

Despite the higher premiums, PPO plans can lead to higher out-of-pocket expenses in certain situations. While you have the freedom to choose providers outside the network, you’ll typically face higher copayments, coinsurance, and deductibles for these out-of-network services. This means you might end up paying more for care even with a PPO plan, especially if you frequently seek treatment from out-of-network providers. For instance, a visit to an in-network specialist might cost you $20, while a visit to an out-of-network specialist could cost $50 or more.

PPO vs. Other Insurance Types

Choosing the right health insurance plan can be a daunting task, as there are various options available, each with its own set of advantages and disadvantages. Understanding the differences between these plans is crucial to making an informed decision that best suits your individual needs and circumstances. This section compares and contrasts PPO insurance with other common insurance types, including HMO and POS, to help you navigate the complex world of health insurance.

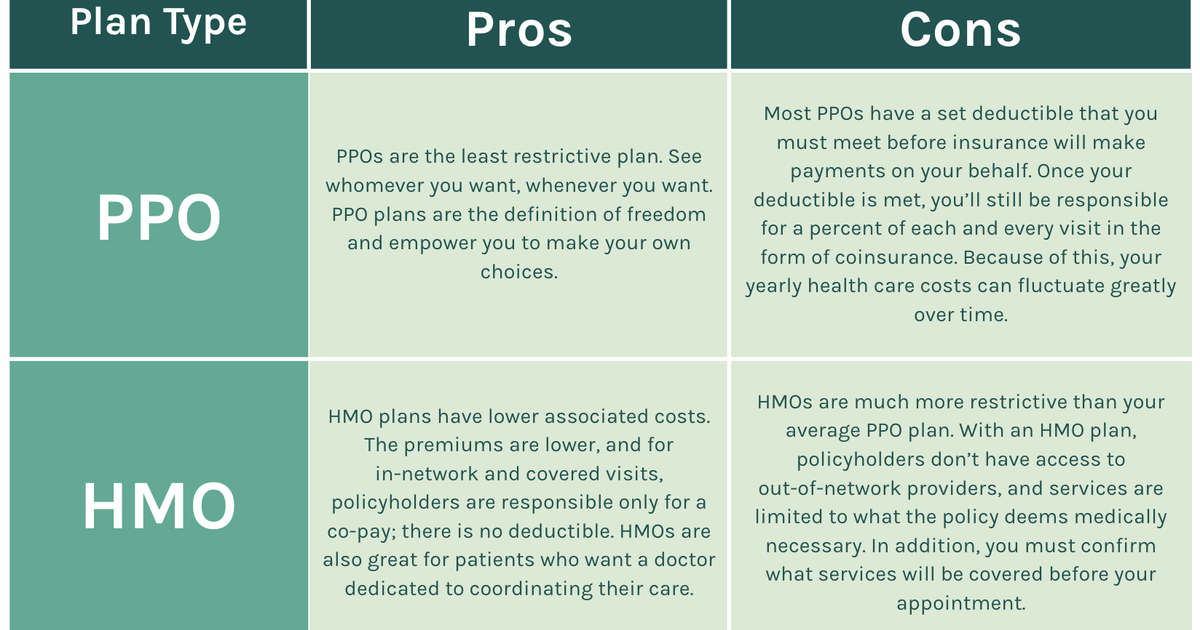

Key Differences Between PPO and Other Insurance Types

The following table summarizes the key differences between PPO insurance and other common insurance types, highlighting factors like network restrictions, cost, flexibility, and other relevant aspects. This comparison helps you understand the trade-offs involved with each plan and determine which might be the most suitable for you.

| Plan Type | Network Restrictions | Cost | Flexibility | Other Features |

|---|---|---|---|---|

| PPO | Wide network of providers, out-of-network coverage available | Generally higher premiums than HMOs, but lower deductibles and copayments | High, can see any provider in the network without referrals | May offer preventive care coverage and prescription drug benefits |

| HMO | Limited network of providers, referrals required for specialists | Generally lower premiums than PPOs, but higher deductibles and copayments | Lower, must see in-network providers and obtain referrals | May have lower out-of-pocket costs for in-network services |

| POS | Combination of HMO and PPO features, limited network, but out-of-network coverage available | Premiums and costs vary depending on the plan | Moderate, referrals may be required for specialists, but out-of-network coverage is available | Offers flexibility while maintaining some cost control |

Situations Where Different Insurance Types Might Be More Suitable

The best type of insurance plan for you depends on your individual needs and preferences. Consider the following scenarios to understand when one insurance type might be more suitable than another:

- PPO: PPO plans might be a good choice for individuals who value flexibility and want the freedom to choose their providers. They are also suitable for those who expect higher healthcare utilization, as they offer out-of-network coverage. For example, someone with a chronic illness or who travels frequently may find a PPO plan more beneficial.

- HMO: HMO plans are generally more cost-effective for individuals who prioritize lower premiums and have a stable primary care physician within the network. They are also a good option for individuals who are relatively healthy and don’t anticipate frequent healthcare visits. For example, a young and healthy individual with limited healthcare needs might find an HMO plan more advantageous.

- POS: POS plans provide a balance between cost and flexibility. They are suitable for individuals who want a wider network of providers than HMOs, but still desire cost control. For example, someone who needs occasional specialist care but prefers to see their primary care physician within the network might find a POS plan a good fit.

Choosing a PPO Plan

Navigating the world of health insurance can be daunting, especially when it comes to choosing a plan that meets your specific needs. PPO plans offer flexibility and a wide network of healthcare providers, making them a popular choice for many individuals. However, selecting the right PPO plan requires careful consideration and research.

Factors to Consider When Comparing PPO Plans

Before diving into the details of specific plans, it’s crucial to understand the key factors that influence your choice. These factors help you narrow down your options and make an informed decision.

- Your Healthcare Needs: Consider your medical history, current health status, and potential future needs. If you have chronic conditions, require specialized care, or anticipate frequent doctor visits, a plan with a broader network and coverage for your specific needs is essential.

- Your Budget: PPO plans come with varying premiums and out-of-pocket costs. Determine your budget and prioritize plans that fit within your financial constraints. Factor in deductibles, copayments, and coinsurance, as these costs can significantly impact your overall healthcare expenses.

- Your Location: PPO networks vary by region. Ensure the plan you choose covers providers in your area, particularly if you rely on specific specialists or hospitals. Check the plan’s provider directory for a comprehensive list of participating healthcare professionals.

- Your Preferred Providers: If you have a specific doctor or hospital you prefer, verify their participation in the plan. A plan that includes your preferred providers can enhance your healthcare experience and ensure continuity of care.

- Coverage for Prescription Drugs: PPO plans often include prescription drug coverage, but the specific formularies and cost-sharing arrangements can differ. Review the formulary to ensure your necessary medications are covered and understand the associated costs.

A Step-by-Step Guide to Researching and Choosing a PPO Plan

Selecting the right PPO plan involves a systematic approach to ensure you make a well-informed decision. This step-by-step guide can help you navigate the process:

- Identify Your Needs: Assess your healthcare needs, including medical history, anticipated healthcare services, and any specific requirements. This step sets the foundation for your search.

- Determine Your Budget: Establish a realistic budget for your health insurance premiums and out-of-pocket expenses. This step helps you narrow down your options to plans that fit your financial constraints.

- Research PPO Plans: Explore different PPO plans offered by insurance providers in your area. Compare premiums, deductibles, copayments, coinsurance, and coverage details to identify plans that align with your needs and budget.

- Review Provider Networks: Verify the plan’s provider network to ensure your preferred doctors and hospitals participate. Use the provider directory to confirm coverage and access information about specific healthcare professionals.

- Compare Formularies: If you require prescription medications, review the plan’s formulary to ensure your necessary medications are covered. Understand the associated costs and potential cost-sharing arrangements.

- Consider Additional Benefits: Some PPO plans offer additional benefits, such as wellness programs, preventive care coverage, or discounts on health-related services. Evaluate these benefits and their potential value to you.

- Read the Fine Print: Carefully review the plan documents, including the summary of benefits and coverage, to understand the specific terms and conditions. Pay attention to any exclusions or limitations.

- Seek Professional Advice: If you have questions or need guidance, consult with a licensed insurance agent or broker. They can provide expert advice and help you make an informed decision based on your individual circumstances.

Real-World Examples of PPO Plans

PPO plans are widely available from various insurance providers, offering a range of coverage options and costs. Understanding real-world examples of PPO plans can help individuals make informed decisions about their health insurance needs.

Examples of PPO Plans

This table provides examples of PPO insurance plans offered by major insurance providers, highlighting key features and costs:

| Provider Name | Plan Name | Key Features | Cost (Monthly Premium) |

|---|---|---|---|

| Anthem | Anthem Blue Cross Blue Shield PPO 1000 | Wide network, low deductible, high out-of-pocket maximum | $450 |

| UnitedHealthcare | UnitedHealthcare Choice Plus PPO | Large network, lower co-pays, prescription drug coverage | $380 |

| Cigna | Cigna Open Access Plus PPO | National network, preventive care coverage, telehealth services | $420 |

A Hypothetical Scenario

Consider a person named Sarah, who is looking for a new health insurance plan. Sarah is in good health and is looking for a plan with a wide network, low deductibles, and affordable premiums. Sarah is also concerned about out-of-pocket costs.

In this scenario, Sarah would likely consider factors such as:

* Network Size: Sarah would prioritize a plan with a wide network of healthcare providers to ensure she has access to quality care in her area.

* Deductible: Sarah would prefer a plan with a low deductible to minimize out-of-pocket expenses before insurance coverage kicks in.

* Premium Costs: Sarah would consider the monthly premium costs and compare them to her budget.

* Out-of-Pocket Maximum: Sarah would also consider the out-of-pocket maximum to understand the maximum amount she could be responsible for in a given year.

Based on her priorities, Sarah might choose a plan like the Anthem Blue Cross Blue Shield PPO 1000. This plan offers a wide network, low deductible, and high out-of-pocket maximum, making it a good option for individuals who are looking for comprehensive coverage with relatively low out-of-pocket expenses.

PPO Insurance and Healthcare Costs

PPO insurance plans, with their flexibility and network options, can have a significant impact on healthcare costs. Understanding how these plans work and their potential cost implications is crucial for both individuals and employers seeking to manage healthcare expenses effectively.

Impact of PPO Plans on Overall Healthcare Costs

PPO plans, by offering greater choice and flexibility, can influence overall healthcare costs in various ways. One key aspect is the potential for higher out-of-pocket expenses compared to HMO plans. This is because PPO plans generally have higher deductibles and copayments. However, the ability to access out-of-network providers can lead to higher overall healthcare spending, particularly for those who frequently utilize specialized or expensive treatments.

Managing Healthcare Expenses with PPO Plans

PPO plans offer several features that can help individuals manage healthcare expenses:

- Negotiated Rates: PPO plans typically negotiate lower rates with healthcare providers within their network. This can result in reduced costs for covered services.

- Preventive Care Coverage: Many PPO plans cover preventive care services like annual checkups and screenings at no cost. These services can help detect health issues early, potentially reducing the need for more expensive treatments later.

- Health Savings Accounts (HSAs): PPO plans are often eligible for HSAs, allowing individuals to save pre-tax dollars for healthcare expenses. These funds can be used to cover deductibles, copayments, and other out-of-pocket costs.

Role of PPO Plans in Promoting Affordable Healthcare Access

PPO plans can play a role in promoting affordable healthcare access by:

- Wider Network Access: The broader network of providers offered by PPO plans can provide individuals with greater access to healthcare services, especially in areas with limited provider availability.

- Flexibility in Provider Choice: PPO plans allow individuals to choose providers outside of the network, providing more options for those seeking specific expertise or convenience.

- Potential for Lower Premiums: While PPO plans may have higher out-of-pocket costs, they can sometimes have lower monthly premiums compared to other types of health insurance.

Final Summary

In conclusion, understanding the nuances of PPO insurance is essential for making informed decisions about your healthcare coverage. By weighing the benefits and drawbacks, comparing PPO plans to other options, and carefully considering your individual needs, you can choose a plan that best suits your circumstances. Remember, navigating the complexities of healthcare insurance is a journey, and this guide provides a valuable roadmap to help you make the right choices for your health and well-being.